Some Known Details About Ach Processing

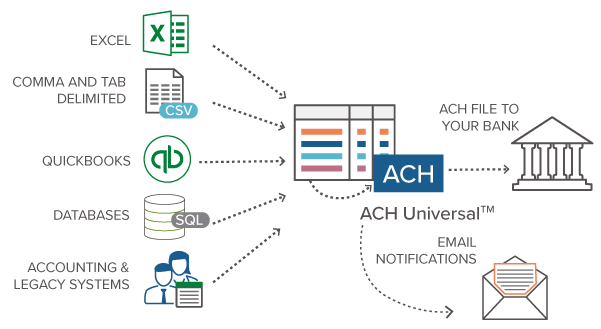

Regardless of what type of ACH payments are involved, a transfer is a procedure of 7 actions, which begins with the cash in one account as well as ends with the money getting here in another account. ACH settlements start when the mastermind (payer)begins the process by asking for the deal. The producer can be a customer, service, or a federal government firm.

When a transaction is started, an entry is submitted by the financial institution or repayment cpu taking care of the first stage of the ACH repayments procedure. The bank or settlement cpu is called the Originating Vault Financial Organization (ODFI). Banks usually send ACH access in batches, commonly 3 times a day throughout routine organization hrs.

Federal Reserve financial institutions and also the EPN are national ACH operators. As soon as received, an ACH driver types the batch of entrances right into down payments and settlements, and repayments are after that arranged into ACH credit as well as debit settlements. This ensures that money is transferred in the appropriate instructions. After sorting access, the ACH operator sends them to their predestined bank or banks, recognized as a Getting Vault Financial Establishment (RDFI).

Rumored Buzz on Ach Processing

When obtaining ACH repayments, the receiving financial establishment either credits or debits the obtaining bank account, depending on the nature of the purchase. While the overall cost associated with approving ACH payments differs, ACH charges are typically much less expensive than the costs connected with accepting card settlements. One of the biggest cost-influencers of approving ACH settlements is the volume of transactions your service intends to procedure.

Whether you're an acquirer, settlements processor or vendor, it's essential to be able to acquire full real-time visibility into your settlements ecosystem. Poorly carrying out systems raise aggravation throughout the entire repayments chain. It can cause lengthy lines up, the internet likelihood of customers abandoning purchases, and discontentment from clients drastically influencing income.

IR Transact streamlines the complexity of handling modern repayments communities, including ACH payments. Bringing real-time visibility as well as repayment tracking to your entire environment, Negotiate uncovers exceptional insights into ACH transactions and settlements trends to help you simplify the repayments experience, transform data right into knowledge, as well as guarantee the payments that keep you in business.

Ach Processing Things To Know Before You Get This

Chances are you have already made use of ACH repayments, however are not familiar with the jargon. ach processing. Some of the instances of ACH purchases consist of: Online bill repayments with your financial institution account, Moving cash from one bank account to another, Paying vendors or getting cash from clients using straight down payment, Straight down payment pay-roll to an employee's monitoring account used by business, Allow's check out ACH settlement refining a lot more in information.

The ACH network of economic establishments (banks and also lending institution) visit the site facilitates deals in the United States as well as is managed by National Automated Clearing Residence Association (NACHA). According to NACHA, ACH payments each day went beyond 100 million in February 2019. The most recent numbers from NACHA disclosed a 7. 1% boost in ACH purchase volume for the first quarter of 2020, with B2B repayments uploading an 11.

For circumstances, you transfer money to a Silicon Valley Checking account from your Financial institution of America account. As well as somebody does an inverted transaction. Both the banks have to credit scores as well as debit each various other's accounts. An instantaneous credit/debit procedure for each deal could seem faster, but has a great deal of underlying downsides.

ACH More Bonuses is one such central clearing system for banks in the US. ach processing. Cable transfers are interbank electronic repayments. While cable transfers seem to be comparable to ACH transfers, here are some vital distinctions in between them: Can take a couple of company days, Immediate, Free for a receiver, nominal fees ($1) for a sender, Both the sender and receiver are charged fees.

The Buzz on Ach Processing

Can be disputed if problems are fulfilled, When launched, can not be canceled/disputed, No human intervention, Typically includes bank workers, Both send as well as request settlements. For payment demands, you require to publish the ACH documents to your financial institution.

Your consumer licenses you to debit their checking account on his behalf for reoccuring deals. Let's say Jekyll needs to pay an amount of $100 to Hyde (presume they're 2 various individuals) as well as makes a decision to make a digital transfer. Here is an action by action malfunction of how a financial institution transfer via ACH jobs.